|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 30 Year Mortgage Refinance Rates Today: A Comprehensive GuideRefinancing a 30-year mortgage can be a strategic financial move, especially when interest rates are favorable. Today's economic landscape presents unique opportunities for homeowners looking to optimize their loan conditions. This article delves into the current 30-year mortgage refinance rates and how they can benefit you. What Influences 30 Year Mortgage Refinance Rates?The rates are influenced by various factors including the economy, the Federal Reserve's monetary policy, and the bond market. Your credit score and loan-to-value ratio also play significant roles. Economic FactorsOverall economic health affects interest rates. In times of economic growth, rates may rise, whereas during downturns, they may fall to encourage borrowing. Personal Financial HealthYour personal financial situation significantly impacts the rate you can secure. A higher credit score often results in better rates.

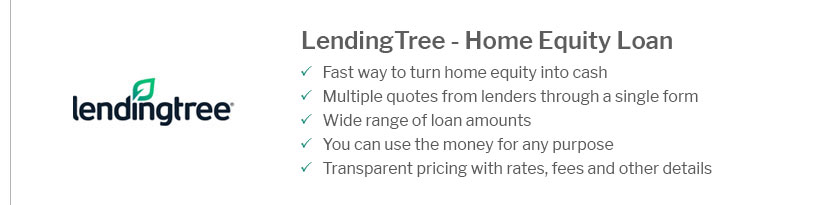

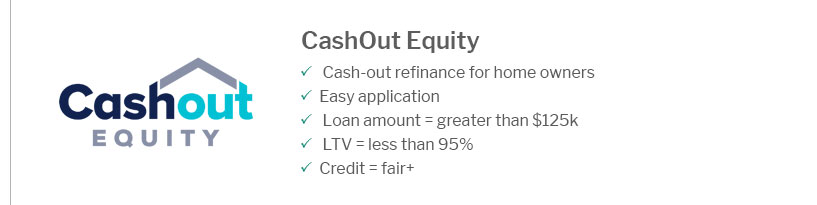

Benefits of RefinancingRefinancing can lead to substantial savings over time. It can also provide immediate relief through lower monthly payments or cash-out refinancing. Lower Monthly PaymentsBy securing a lower interest rate, you can reduce your monthly mortgage payment, freeing up cash flow for other expenses. Consider this: The difference between a 3.5% and a 4% interest rate on a $300,000 loan can lead to significant savings over the life of the loan. Cash-Out RefinancingThis option allows you to tap into the equity of your home, providing cash for renovations or debt consolidation. To explore options such as home is possible refinance, consider discussing with a financial advisor who can tailor the best plan for you. Challenges and ConsiderationsRefinancing is not without its challenges. Closing costs, for example, can be significant, and it may take years to break even on these expenses. Closing CostsThese costs can include application fees, appraisal fees, and other expenses. It's crucial to calculate whether the long-term savings outweigh these initial costs. Breaking EvenCalculate how long it will take for your savings to cover the closing costs. This is known as the break-even point. For those considering home refinance after chapter 13, special considerations may apply regarding eligibility and timing. FAQ

By understanding the intricacies of refinancing, you can make informed decisions that align with your financial goals. Whether you aim to lower your payments or access your home's equity, today's rates offer various opportunities for savvy homeowners. https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; 30 Year Fixed $1,347 ; 15 Year Fixed $1,701 ; 5y/6m ARM Variable $1,364. https://www.businessinsider.com/personal-finance/mortgages/current-mortgage-refinance-rates

A 30-year fixed-rate mortgage will have a higher rate than a mortgage with a shorter term. Rates have been elevated recently and are higher than ... https://www.citizensbank.com/loans/mortgage-refinance.aspx

Ready to Refinance. With a home mortgage. Start Now*. Today's Mortgage Refinance Rates. These rates and payments are based on a $300,000 loan amount. 30-Year ...

|

|---|